📌 Section-I: General Intelligence & Reasoning

This section tests analytical and logical thinking skills.

-

Analogies, Similarities, Differences

-

Space Visualization, Problem Solving

-

Analysis, Judgment, Decision Making

-

Visual Memory, Discrimination, Observation

-

Relationship Concepts

-

Arithmetical Reasoning & Number Series

-

Verbal and Figure Classification

-

Abstract Ideas & Symbolic Relationship Problems

-

Arithmetical Computations & Analytical Functions

|

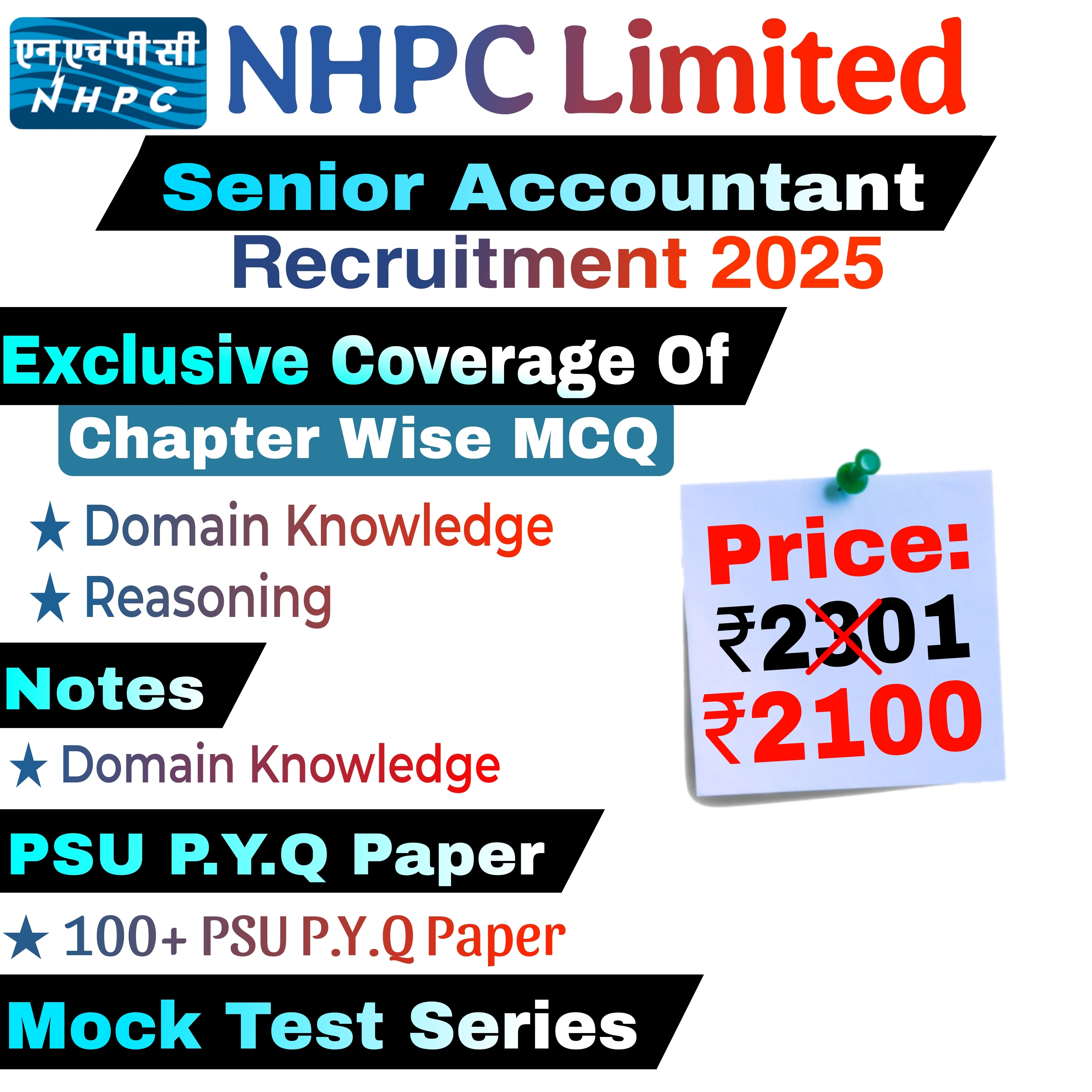

NHPC Sr. Accountant Recruitment 2025 Related Blogs

|

|

|

NHPC Sr. Accountant Recruitment 2025 Pdf

|

|

|

NHPC Sr. Accountant Recruitment 2025 Paper Patterns

|

|

|

NHPC Sr. Accountant Previous Year Cut-off

|

|

|

NHPC Sr. Accountant Previous Year Question Papers

|

|

📌 Section-II: General Awareness

This section checks knowledge of current affairs and general topics.

-

Current Events (National & International)

-

History, Culture, Geography of India & Neighbouring Countries

-

Economic Scene & General Polity

-

Constitution, Governance, Scientific Research

-

Everyday Science & Social Awareness

📌 Section-III: Domain Specific (Professional Knowledge)

I. Accounting & Financial Management

-

Indian Accounting Standards (Ind AS), Financial Statements (Schedule III – Companies Act, 2013)

-

Ratio Analysis, Cash Flow & Fund Flow Analysis

-

Bank Reconciliation Statement (BRS)

-

Costing: Material Cost, Labour Cost, Overheads, Fixed & Variable Costs, Standard Costing, Marginal Costing, Break-Even Analysis, Contribution Margin

II. Budgeting & Capital Investment

-

Budget & Budgetary Control

-

Types of Budget

-

Payback Period, Net Present Value (NPV), Internal Rate of Return (IRR)

III. Direct Taxation (Income Tax Act, 1961)

-

Income from Salary, Business & Profession

-

Advance Tax, MAT, Tax Returns, Deductions

-

Tax Audit

-

TDS provisions & Filing of e-TDS Return

IV. Indirect Taxation

-

Central Excise, Customs Duty, Service Tax

-

VAT, CST, GST Act & GST Returns

-

TDS under GST

V. Project Finance & Investment

-

Financial Models of Infrastructure Projects (SPV, PPP)

-

Raising of Debt (Domestic & International)

-

Raising Funds through Equity

-

Project Appraisal

VI. Audit & Compliance

-

Internal Audit, Internal Control & Investigations

-

Physical Verification of Assets

-

Depreciation Methods

Follow Me: -

|

YOUTUBE |

|

|

Telegram Discussion Group |

|

|

Telegram Vacancy update Group |

|

|

|

|

|

WhatsApp Discussion Group |

|

|

WhatsApp Vacancy update Group |

|

|

WhatsApp Channel |

|

|

|

|

Important Links |

|

|

Syllabus Video |

|

|

Syllabus PDF |

|

📌 Key Highlights of Exam Syllabus

-

Reasoning & Awareness help build scoring balance.

-

Professional Knowledge (Accounting, Tax, Costing, Audit, Finance) carries maximum weightage.

-

Focus on Ind AS, GST, Direct Tax, Costing & Financial Management for maximum preparation impact.